The largest financial pyramids in history. Making money on pyramids - how to make money on a financial pyramid Companies financial pyramids

26.07.16 6270 0

How financial pyramids work and who makes money from them

What kind of financial pyramids are they?

Financial pyramids are a dangerous and illegal way to invest money. Although the first pyramids appeared at the beginning of the last century, they have survived in different forms to this day. In 2017, almost all classic pyramid schemes moved to the Internet.

Pyramids operate under a fraudulent scheme. You make a contribution to the pyramid - your money is distributed among other participants. To earn money yourself, you need to attract new investors. Your profit will come from their money. The more new members you invite, the more you earn.

The pyramid and your profit grows while new participants join the system. As soon as the list of new investors stops being replenished, the financial pyramid will collapse - and you will lose money.

Fact: you can make money on the Internet. Many. As much as you like, depending on your abilities and aspirations. Here are your options

List of popular financial pyramids in 2017:

- Classic pyramids like MMM, where money is transferred from one participant to another.

- False investors who offer intermediary for trading on Forex market. Typically, such companies pretend to be traders, but they themselves act according to the classic scheme: they collect money from some investors and give it to others.

- Disguised pyramids that pretend to be network marketing: they sell dubious dietary supplements, cosmetics and sports bracelets. A similar scheme works here: the more new sellers you bring, the more you earn. Personal selling do not play a role.

Is the activity of pyramid schemes on the Internet legal?

Differently. In Russia there is no ban on companies similar to Internet pyramids. The law prohibits only projects that do not conduct official investment activities and pay all profits to investors at the expense of new participants.

Therefore, sometimes pyramid schemes disguise themselves as legitimate network marketing (MLM) companies. In such companies the same scheme works as in ordinary pyramids. Only here you don’t just invest money in a pyramid, but buy some cheap junk for resale.

In fact, there is no need to look for buyers. Unlike honest MLM companies, pyramids don’t care about your sales. Products are a cover: no one needs magic bracelets and miracle devices. You receive the main reward for attracting new sellers.

It’s hard to find fault with “legal pyramids”: they pay taxes, they have goods and buyers. Only classic pyramids are prohibited, the entire income of which depends on attracting new participants, and not on the sale of products.

In 2016, the State Duma adopted a law according to which the creators and participants of such pyramids can be fined. For creating and advertising a pyramid, an individual will pay a fine of 5 to 50 thousand rubles, and legal entities- from 500 thousand to a million. It turns out that even if you just share a picture of MMM on Facebook, you can be fined by law for advertising a pyramid scheme on the Internet.

Who makes money in online pyramids?

But don't expect to get rich. Remember that any pyramid will eventually fall apart. Even if you remain in the black, you will steal money from other, less fortunate participants in this network. Pyramids are based on those who came last and did not manage to collect the money in time.

The founder of the largest financial pyramid in the post-Soviet space, MMM, Sergei Mavrodi, died today.

Review of the most famous financial pyramids in the world. Photo: exame.abril.com.br

On March 26, at the age of 63, Sergei Mavrodi, the founder of a financial pyramid, which affected, according to various estimates, from 10 to 15 million people, died. The editors suggest remembering what MMM was doing and similar scams that are popular among people who want to get rich quickly without much effort.

"MMM"

This is the largest financial pyramid in the CIS countries. Organized by Sergei Mavrodi together with his wife and brother in 1989, the enterprise promised a record profitability of up to 1000% per annum. The company's motto was “Tomorrow is more expensive than today.”

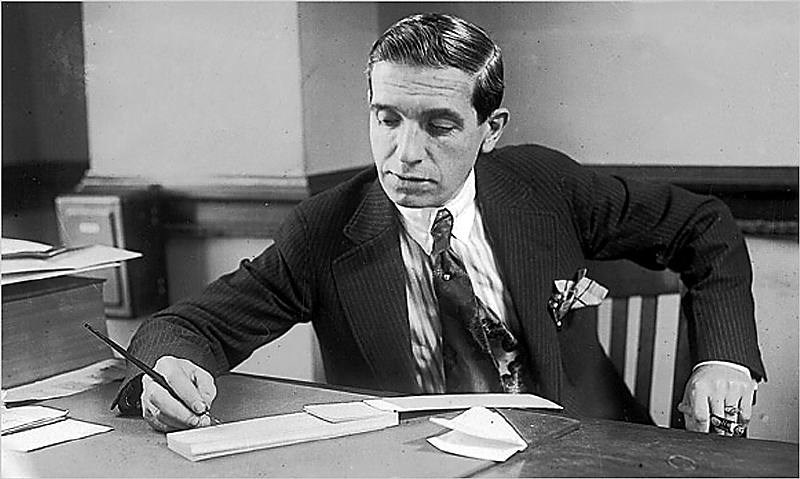

Sergey Mavrodi is the founder of the most famous financial pyramid in the CIS countries, MMM. Photo: infodota.com

Considering the difficult economic times and low financial literacy of people, MMM attracted, according to various estimates, from 10 to 15 million people. The pyramid itself existed for more than 5 years. Its author earned about $2 billion during this period. When MMM was declared bankrupt in 1997, millions of investors lost all their money. After Mavrodi’s arrest, several trucks completely filled with money were removed from his office. Their recount alone took about a month.

In 2003, he was convicted in Russia of large-scale fraud. And sentenced to 4.5 years in prison for fraud. However, this did not stop Mavrodi from again attracting people to the pyramid in 2011 and 2012. And in 2016 new project Sergei Mavrodi under the name "MMM Global" offered to make deposits in the Bitcoin cryptocurrency under high interest rates. But, fortunately, they did not become as popular as MMM in the 90s.

"Lo System"

The first financial pyramid in Europe is considered to be the system created by the Scottish economist John Law in 1716-1720 in France. Since childhood, Law was distinguished by his desire to live differently from everyone else, which required a lot of money. At first he tried to play cards, but it never brought him any profit. John then had the idea of creating money in financial institutions rather than in gold or silver mines, and he proposed replacing metal coins with paper money. Law moved to France. There, the king's regent, the Duke of Orleans, supported his idea to establish a bank that would issue banknotes backed by the treasury and land.

A satirical depiction of the workings of the pyramid and its collapse ru.wikipedia.org

But the genius financier did not stop there. In 1717, the Mississippi Company, or Western Company, began its work. Thanks to his fame and ability to manipulate the opinions of the crowd, Law was able to raise unprecedented demand for shares of a company that was doing who knows what. There was a stir both among merchants and among ordinary people. But when it became clear that the Western Company was not conducting any significant activities and was not bringing in any real profit, the owners of the shares began to get rid of them en masse. The "Lo System" collapsed, and its author fled to Italy.

"Ponzi Scheme"

In the USA financial pyramids appeared only 100 years later. In 1919, the first of them was created by Italian emigrant Charles Ponzi. Like John Law, Ponzi always wanted to become rich and successful, and eventually came up with a scheme to make money by raising money from other people.

One day Charles wrote a letter to a Spanish company with a proposal to publish an international magazine. The answer came to him very quickly, and the envelope contained international coupons that could be exchanged for stamps for a return letter. The most important detail was the exchange rate of the coupons: in Spain one stamp was given for one coupon, but in the USA it was six. This gave Ponzi the idea of creating a pyramid company.

In paid articles in the press, the Italian entrepreneur invited people to buy shares of his company, supposedly engaged in the purchase and sale of goods around the world, and receive an unheard-of profit - 150% of the invested amount in 45 days. Both officials and ordinary citizens very quickly bought into the promises. Thus, payments to the company's investors were made from the money of new participants.

But like all pyramids, the Ponzi Scheme collapsed very quickly. A friend of Charles, from whom he borrowed money at the beginning of his activity, sued Ponzi. As a result, all his accounts were frozen, investors lost $2 million, and the author of a simple and profitable scheme was sentenced to 5 years in prison.

Bernard Madoff's Greatest Pyramid

This pyramid, according to some experts, is the largest financial scam in history. The number of victims includes 3 million people and several hundred organizations. Damage is estimated at about $64.8 billion.

The author of this scheme, Bernard Madoff, unlike other financial fraudsters, promised all investors that he had created investment fund Madoff Investment Securities made small but stable profits. A return of 12-13% per annum convinced many large companies, famous people and officials to invest in the company. As a result, the number of investors exceeded 3 million, and the amount of money raised amounted to billions of dollars.

The fund existed for 15 years, until in 2008 a number of large companies turned to Madoff with a request to return their funds and interest (about $7 billion had accumulated). Of course, the fund was unable to pay such an amount. The pyramid collapsed. As it turned out during the investigation, the Madoff fund owed its clients more than $65 billion. The author of the scheme (who, by the way, was betrayed by his own sons) received 150 years in prison.

Wang Feng's Ant Farms

In 1999, Chinese entrepreneur Wang Feng came up with an original way to make money. Photo: Daily Mail

In 1999, Chinese entrepreneur Wang Feng came up with an original way to make money. He invited everyone to become investors in his company. For $1,500, investors received a box of “special” ants, which had to be raised according to a special secret scheme for 90 days. Wang Feng claimed that the ants were used to make medicine. In reality, of course, this was not the case. Every 14 months, the company's investors received $450, which corresponded to an annual return of 32%.

Millions of people contributed their money over the course of two years, allowing Chinese swindler raise more than $2 billion. Wang Feng himself became a highly respected businessman in China and was nominated for various prizes and awards. But soon the pyramid collapsed, and Wang Feng was sentenced to death.

Lou Pearlman stock

Not everyone knows the name Lou Pearlman. But many people have heard the names of the musical groups he created, such as Backstreet Boys and NSync. However, not everyone knows exactly about the financial scams that Perlman pulled off.

In 1981, Lu created several fictitious companies that existed only on paper and did not conduct any activity. He then issued shares of these companies and placed them on the stock exchange. Interested in the “profit growth” that Perlman constantly reported in his published reports, many individuals and even large financial companies started buying Lou Pearlman's shares.

The scheme lasted for 20 years, but in the end the fraud was discovered. Lu was sentenced to a $1 million fine and 25 years in prison, and shareholders of his shell companies lost about $300 million.

18-02-2016, 08:21

Financial pyramids have existed at all times since the first monetary units. There are many different opinions regarding such organizations, and even in the United States there are many successful pyramid schemes today, but all pyramid supporters should know: every pyramid scheme is doomed to fail.

Financial pyramids - what are they?

A financial pyramid is a financial structure in which the entire income of system participants is compiled and formed from the contributions of their followers. Often in modern financial pyramids they either hide real sources of income or hide behind non-existent or insignificant goods.

Investors are usually promised huge returns, sometimes up to 300% per annum, which seems unrealistic, and this first feeling is not deceptive. Since income is generated only from the contributions of new participants, there will be income only as long as new participants appear. Such high profitability is simply impossible to maintain for a sufficiently long time, and the conditions of the pyramids obviously become impossible to fulfill.

How the pyramids fall apart

They can register as financial institutions, or as companies that sell minor services and goods. For example, selling courses on the Internet that can actually be found for free on websites. As a result of the collapse of such organizations, only 10% of people are able to get their money back, if at all.

It happens that the organizers of the pyramid simply take all the money from the fund at a certain moment, after which they declare that their electronic accounts were permanently blocked by payment systems. In such cases, the organizers place all the blame on payment system employees who allegedly stole all the money, or on their partners.

After the collapse of the pyramid, the organizers, oddly enough, do not flee to Europe or the USA! I can’t believe it, but they not only remain in the CIS, but also establish more and more financial pyramids in order to carry out the same operation again.

A relic of the past or a problem of our time?

Many are sure that financial pyramids in Russia are a thing of the past along with the legendary MMM. They will benefit from social research conducted by a group of online activists led by Bella Kesselman. Faced with thousands of people who suffered from the activities of not old, but new, modern pyramids, activists not only created an association on the Internet to combat the newly formed pyramids, but also conducted a sociological survey on the topic of the most influential and dangerous pyramids today.

Thus, the famous “Zeus Business Incubator” took first place in the ranking of dangerous pyramids in the CIS, with 25.8% of the votes. The organization offers to purchase the right to access certain online courses that teach how to do business and make money on the Internet. In fact, there is a minimal number of courses in the system, and not a single course is unique - any similar information can be found on other resources completely free of charge.

And Zeus participants don’t need any lessons in making money, since they are immediately offered an affiliate program through which they can earn big money by selling access to the same unnecessary courses! The problem is that in this case, the sale of courses covers a financial pyramid that is on the verge of collapse. Reminiscent of trading air or water from a river.

A similar company, WIC-Holding, was in second place in the ranking. The company offers customers a poor selection of inexpensive and simple goods at incredible prices. Again, 100% of people come to a company not for the sake of a product that could be bought much cheaper elsewhere, but for the sake of affiliate program, which is a typical financial pyramid.

Third place among the most dangerous financial pyramids was shared by Elevrus (12.2%) and Mercury Mutual Fund (12.3%). The system is approximately the same, and the only option for participants to make a profit is to attract new participants, whose contributions constitute the income of the company’s former “partners”. The organizers present their participants with calculations and murky traffic patterns financial resources, but if you look at it, this is a classic pyramid.

Other financial pyramids received significantly fewer votes: Webtransfer-finance (10.5%), OneCoin (4.7%), FG Legion (3.5%), Rail SkyWay (3.1%) and Vis Energy (2.6%). Among the respondents, 10.3% believed that the list does not include the most dangerous pyramids, because they either consider other similar organizations more dangerous, or are supporters of pyramids.

Why are pyramids dangerous?

Even in countries with a serious financial settlement system, pyramid schemes can have serious consequences. In a state where the settlement system is weak, the collapse of another financial pyramid can cause catastrophic consequences that will affect the well-being of the country. For example, in Jamaica, at one time, the activities of financial pyramids reduced the country’s GDP by 12 percent, and in the United States, during protests by pyramid depositors who lost their money, a state of emergency had to be introduced.

By their existence, financial pyramids cause an outflow of funds from real investment schemes in the production or development of the country’s business. In addition, they undermine citizens' trust in legal financial institutions, such as pension fund or banks. The collapse of large pyramids can lead to political or economic crises in a region or state.

And, of course, pyramids will certainly lead to the loss of the deposits of the majority of their participants. Moreover, the larger the pyramid, the more victims there will be, and the number of potential victims of the pyramid is growing exponentially every day.

The fight against pyramids in the state

The system of regulation and control over pyramids should be thought out at the state level. Because in countries where there are more important problems, statesmen There is simply no time for this, and it is the countries that are experiencing economic crises that most often suffer.

When pyramids grow to large sizes, government agencies not only cannot, but have no desire to regulate or close them, since this will anger hundreds of thousands of investors against government officials. This is a tactic doomed to failure in advance, since the pyramid will collapse anyway, and the aggression of investors will be directed at the state, which was not able to influence the activities of the organization.

Hello, dear readers of my blog site. Well, today I will continue to talk and give examples of exposing financial pyramids on the Internet. Oh, sorry, network marketing, built on recommendations from friends and family -))). Once upon a time I wrote an article about how network marketing works after which a huge wave of criticism and accusations fell on me that I myself could not make money there, and that I was such a loser. Well, it is clear that those who invite people actively begin to write negative reviews on various forms and blogs so that people believe them, and not those who want to take off the rose-colored glasses from the losers who believed them. I admit, yes, I attended seminars and business gatherings of 3 such pyramids in Kazan and they all closed, and criminal cases were brought against their owners.

I wonder if you took part in any business community gatherings in expensive restaurants and hotels. Let's remember what is required of those who want to join the club and start earning millions and living richly.

The essence of a financial pyramid

Let's look at the example of any financial pyramid and consider what is required from gullible sheep, forgive future rich people who are now bored in retirement and have a lot of extra money:

- New participants urgently need to buy a business place and only today at prices of 60,000 or more;

- It is required to wear beautiful evening dresses with expensive jewelry for the evenings, so that they seem rich and wealthy (and in the morning she goes to work at a factory or private security company as a security guard);

- Attract by word of mouth binary system new participants and receive interest from them, and then attract even more people.

And that's not all. You can get a couple of thousand rubles, which they will give you for scamming your friends, while you yourself are a member of a criminal group. I wonder how your friends, colleagues and loved ones will trust you in the future? Have you thought? If you get into trouble or want to do business with someone, then I would give you 3 letters for putting me on the spot. And no matter what you ask, everyone unanimously says that I believed so, it’s the whole government that prevents us from spending money, etc. Everyone ends up saying the same thing.

As one of the participants said, when asked what they were doing in the pyramids, she answered: “We have a business cooperative and we sing, dance and have fun.” Yeah. Looking at their faces and in general from the outside, I have the opinion that the people have gone crazy, mainly those who work in low-paid jobs and who want nothing, without doing anything, to get millions on such fools, all this deception in financial pyramids is based. You know, I don’t even feel sorry for them at all, and since I have no brains, let them continue to suffer. Nobody forces them to deposit money without thinking without signing an agreement. In no pyramid you will receive documents stating that you have made your investments, but you will be given documents for loans and other receipts that you voluntarily gave the money -))).

I’m shocked that mothers with many children are running into network marketing and other financial pyramids, I don’t think so, and investing hundreds of thousands.

The number of people from year to year is becoming even larger in such pyramids, where due to the fact that the owners gave out large prizes to their people and demonstrably showed something, someone made money and you can too. All such close associates are already sitting as accomplices. Yes, they are great, they made money, but there are ten of them, and how many are divorced sheep who believed such scammers. There will be an interview in the video regional manager“Mega Lux”, who will tell on condition of anonymity how the pyramid works.

Konstantin Kondakov (manager stock trader), who recorded videos with Russian stars MMSIS (TOP-20 Index). Celebrities categorically refused to give interviews or comments regarding their participation and statements in the advertisement. But in fact, no one invested a penny in this system, but received a fee for the money and admitted it themselves (further in the video). The bottom line was that money in Ukraine and Russia immediately went to offshore companies and scammed everyone. The office itself was opened in an expensive building in Moscow City. When the payments stopped, Kondakov himself and his associates from MMCIS fled to Ukraine with the investors’ money -))). Well, how could it be different?

As soon as the owners fill their wallets and begin to understand that an irreversible peak of saturation of the pyramid is coming and the pair will close, well, the next thing you know, everyone starts running around and trying to get their money back and are left with loans and other obligations.

List of financial pyramids on the Internet that burned down

I will give an example of some pyramids and brief description what they did on the territory of Russia and Ukraine:

Russian social program- the point here was to attract investors who received certificates for the purchase of real estate and vehicles contributing only 20-30% of the final cost, and then it was promised that the investor would be able to buy back everything he invested in.

Pyramid GROWTH- a consumer cooperative that promised high interest rates. Promoted by Andrei Kharlamov, a football player of the Rubin team, and the organizer Andrei and Svetlana Makarov for finance and real estate today. Advertising was handled by Sergei Rost, the one who played with Nagiyev in “Caution Modern”. As there were so many participants, but the very first ones had nothing to pay with, the pyramid burst and everyone was closed. And as always, everyone began to deny it, especially the captain of “Rubin” Kharlamov, who promised money during the crisis.

Intway. com- I took part in this pyramid myself, but I was lucky that I left on time, and I was lured by the fact that they used a stock exchange as well as services for working in networks such as online stores and other gadgets. They sold business places that you need to buy so that you get interest from those who will buy the same places in the future using the binary system. I wrote about her, just in my TOP article(link in first paragraph). A huge role was played by the so-called business coach Permyakov, who rushes from one network company to another and for some reason constantly tells everyone and promises to become millionaires, but for some reason it doesn’t work out for everyone, only for those who attract so many fools to him.

Mega Lux- One of the last high-profile financial pyramids, which was closed in the spring of 2015. There were more than 150 branches throughout Russia. On the website I saw that the last entry was at the 2015 New Year celebration. By the way, here is their website, which now, as I understand it, has been hacked and an advertisement for an online casino has been inserted on it, as well as parts of the materials have been removed and http://mega-luxe has ceased to be supported at all. ru. It’s interesting how millionaires who believed now talk about such pyramids. But it seems to me that they have already found new ones and invested their money there, taken on credit or set aside for the funeral.

Now everyone is sitting, and the site is selling its domain. Anyone who wants can buy and open the same pyramid -))).

ExpertPrav- well, like all such scams, it was already closed around 2015 (their website is expertprav.ru and the second domain is closed expert12.prav. tv). When you went to it on the monitor, a player opened from the computer monitor where they advertised to us new business, which anyone can join. I watched and studied this topic. The bottom line was that that same Permyakov promises to sell us a super product, the essence of which was the use of special additives that need to be added to the fuel tank and gasoline consumption will be saved -))). I remember visiting their seminars where ordinary users conducted seminars using free online broadcast services, and in their background hung an old carpet or even a communal apartment with a terrible interior, well, many who participated saw this.

Here is a video of these scammers and remember this person who constantly runs from company to company and is an important participant.

Colorsoflife. ru- also one of the scam companies, which was aimed at selling large quantities for amounts from 5,000 rubles to its customers. In Kazan, I am an acquaintance with whom, after such a divorce, I stopped communicating at all; we went to their presentation at the expensive Bulgar Hotel, where everyone paid for their seats in the hall. Although representatives came there from France and did it all so beautifully that it was difficult not to believe them. As a result, the company became just an Internet platform where they sell goods and is something like Avon or Amway, whose products are sold by aunties for pennies almost on the streets -))). The site was last updated at the beginning of 2015.

ISIF- this company, in the opinion of many, was useful for shaking the brains of young people, but the essence, as elsewhere, was the same. Everyone lost their money and were left with nothing. The point was personal growth and gaining financial independence and attracting more and more new clients to MLM.

It’s funny to me when, after the pyramids collapse, everyone runs around the courts and says that they were deceived and are asking for protection. From what? From yourself? So they show you the whole essence of your series, programs and TV shows, as well as investigations, and you still bear the money. Well then, there is no need to cry if you are complete sheep. Forgive me, of course, for my directness and rudeness, but I have seen a lot of such people and I think that they themselves are to blame for this and so be it.

This is a small list of financial pyramids that have been widely heard on the Internet, and there are hundreds more of them and new ones appear every day.

Advice: If you want to earn money, then do something with your hands and head. There is no easy money if you are asked to deposit a certain amount and you will become rich. Use your head and logic. There cannot be many rich people and no poor people. In this case, a social explosion will occur. If you want to ride on cruise ships and have expensive villas, then go earn money and open your own business, don’t blame everyone for their fault, but NOT YOURSELF !!!.

I hope in our country our citizens may stop believing and being a herd of sheep, and it’s time to wake up. Look at any news program like “Duty Unit” where almost every week they deceive one or another granny or pensioner aunt who has been scammed into buying a bracelet, dietary supplements or other investments.

Watch the investigation of the honest detective program about the recently closed MLM company Mega Lux and most likely you will see yourself or your friends in these people -))).

Good luck to everyone and see you soon. Leave your comments if you do not agree with my arguments or have experience making money online and such companies. You can attach statements and receipts in the comments to convince our readers that you are right.

Sincerely, Galiulin Ruslan.

The best articles on investing on the Internet!

Means mass media For decades now, people have been accustomed to one idea: you can’t earn anything on pyramids, you can only lose. But is this really so?

But in fact, if you approach the process of investing in highly profitable investment projects professionally, this type of investment can be very profitable. But what is the difference between a professional and an amateur?

One of the differences is that a professional has investment plan with a well-thought-out strategy, which he strictly adheres to.

In this article, I decided to analyze in detail several strategies for investing in HYIPs that will help minimize risks, plan future profits and earn more money.

The first step towards a million.

Probably, most people invest their money in only one project, which they consider the most reliable. This approach is risky and more like gambling.

- Strategy “I’m like everyone else”

- Strategy "Brave Investor"

- Strategy "Steel Eggs"

- Strategy "Rational Thinking"

The second approach is based on the principle of risk diversification, in which we try to minimize our risks.

- Strategy "I don't like champagne"

- Strategy "Wise Investor"

- Strategy “I’m saving for a funeral”

Below we will take a closer look at all the strategies described above and everyone will be able to choose for themselves the one that seems closer to them, based on their personal qualities, goals and financial capabilities.

Investing in one hype.

In this section, we will look at various investment and money management tactics when investing in one classic medium-interest HYIP with a perpetual deposit. For example, this could be a project with a profitability of 30% per month and a deposit included in payments.

We will calculate the strategy based on the following conditions:

- Long-term HYIPs with serious preparation according to the plan should live for more than a year. This is the number we will focus on. That is, we will assume that the project should last another year after you make a contribution.

- The second reason why the period of one year is taken is that the deposit usually works for only 12 months.

1. Strategy “I’m like everyone else.”

This is the strategy followed by most participants in long-term HYIP projects. The idea is that a person invests the entire amount in one fund and withdraws interest every week without replenishing his deposit.

By investing 20,000 rubles, you get 58,392 in a year. By investing 100,000 rubles you get 328,500.

Conclusion. This approach will help minimize risks and recoup your investment as quickly as possible when investing in only one project. But, as often happens, reducing risks also reduces profitability.

2. “Brave Investor” strategy.

The idea is that from the very first week a person begins to divide the payment into 2 equal parts. He takes 50% for himself, and invests 50% again in the project, thereby increasing the deposit.

In the presented calculation, we analyzed 2 cases: an initial deposit of 20,000 rubles and 100,000 rubles.

1 case.

In Elevrus, the minimum deposit is 3,000 rubles, so with such a small deposit we will have to save money for reinvestment within several weeks. As soon as the required amount accumulates, we immediately invest it in HYIP, thereby increasing the deposit and, accordingly, subsequent payments.

As a result, in a year we will be able to increase our deposit from 20,000 rubles to almost 78,000 rubles and at the same time earn almost 60,000 rubles.

Case 2.

In this case, from the first weeks, half of the payment is enough for us to replenish the deposit; it turns out that we are increasing the deposit every week.

As a result, our deposit increases over the year from 100,000 rubles to 513,000 rubles, and at the same time we earn 413,000 rubles.

Let's complicate the strategy.

Now you need to find out whether at some point you should stop reinvesting payments into the deposit and start taking it in full for yourself? To do this, in the last columns in both cases we add the income received up to this time with the current payment multiplied by the number of weeks until the end of the year.

Calculations show that the longer we stick to the strategy chosen at the beginning (split payments in half and reinvest 50%), the greater the profit we will receive, even if the hype stops paying immediately after the end of the year.

Conclusion. This approach increases risks, increases the period of “recapture” of the deposit, but ultimately increases income. If you started using this tactic from the first weeks, then you shouldn’t stop.

3. “Eggs of Steel” strategy.

The meaning of this strategy is that a person reinvests the entire payment amount back into the HYIP, thereby actively increasing his deposit.

For analysis, we will again take 2 cases: an initial deposit of 20,000 rubles and 100,000 rubles.

1 case.

The initial deposit is 20,000 rubles.

In this case, during the first weeks you will have to save money for a new deposit. But gradually the payments reach such a size that it is possible to reinvest every week.

As a result, over the course of a year our deposit increases 19 times from 20,000 rubles to almost 377,000 rubles.

Case 2.

The initial deposit is 100,000 rubles.

In the second case, a deposit of 100,000 rubles allows us to reinvest earnings every week. Due to this, the deposit will increase 29 times from 100,000 rubles to 2,900,000 rubles.

Let's complicate the strategy.

Now we need to answer the question, when is the best time to stop increasing the deposit and start taking payments for ourselves if we plan for the hype to last a year?

To do this, we calculate how much money we can collect before the end of the year for each week. For both cases, it turns out that we can count on maximum income if we spend 39-40 weeks actively increasing the deposit, and after that we start withdrawing money in full, or switch to the “Brave Investor” strategy.

Conclusion. This tactic is very risky, because even the most reliable hype can collapse at any moment. And if this happens during the implementation of this strategy, the investor will lose his entire investment without receiving anything in return. But these tactics provide very rapid growth of the deposit.

4. Strategy “Rational thinking”.

I think this is also a very popular strategy. Its meaning is that a person first returns his entire contribution, and then switches to the “Steel Eggs” or “Brave Investor” strategies.

Below we will again consider 2 options: with a deposit of 20,000 rubles and 100,000 rubles.

1 case.

The initial deposit is 20,000 rubles.

We recoup the initial investment in 18 weeks, and then switch to the “Brave Investor” strategy. As a result, after a year we:

- we return our contribution

- we increase the deposit from 20,000 rubles to almost 50,000 rubles

- At the same time, we earn 29,600 rubles.

Case 2.

The initial deposit is 100,000 rubles.

We recoup the initial investment in 15 weeks, and, as in the previous case, we switch to the “Brave Investor” strategy. The results after a year will be as follows:

- we recoup the deposit

- we increase the deposit from 100,000 rubles to 305,000 rubles

- at the same time we earn 205,000 rubles

Conclusion. This tactic allows you to combine the advantages of different strategies. Good value Risk-return ratio makes this approach very popular among investors.

Investing on the principle of risk diversification.

Below we will look at tactics when investing in pyramids based on the principle of risk diversification (read more about why you can’t keep all your eggs in one basket).

To minimize risks when making money on financial pyramids, we divide the deposit amount into several parts and invest in various projects. In this situation, we will not depend on one hype, so this approach will work for many years. Some projects will be closed, new ones will appear in their place, and our deposit will grow and bring us income.

Let’s take the average option with a yield of 3.5% per week and an average minimum deposit of 4,000 rubles.

5. Strategy “I don’t like champagne.”

The meaning of the approach is that a person invests money, scattering it across different projects. If one of the HYIPs closes, then he immediately finds a new project and makes a contribution to it. He takes all the payments for himself.

The calculations for this strategy are very simple. By investing 20,000 rubles, in a year we receive 36,000 rubles. By investing 100,000 rubles, in a year we receive 183,000 rubles.

Conclusion. This tactic is suitable for those who do not like to take risks at all. If you think that a bird in the hand is better than a pie in the sky, then this strategy is ideal for you.

6. “Wise Investor” strategy.

The essence here is the same as in the “Brave Investor” strategy. The investor takes half of the payment for himself, and reinvests the other half.

For example, let’s take 2 amounts: 50,000 rubles and 120,000 rubles.

1 case.

As a result, at the end of the first year we will increase our deposit from 50,000 rubles to 122,000 rubles and earn 72,500 rubles.

Case 2.

The initial deposit is 120,000 rubles.

In a year, our deposit will grow from 120,000 rubles to 289,000 rubles, and we will earn 174,000 rubles.

Conclusion. This tactic allows you to increase your deposit and consistently receive income from your deposit, and all this with minimal risks. I find this strategy the most interesting.

7. Strategy “Saving for a funeral.”

Here we completely reinvest the received payment, thereby increasing the deposit.

For example, consider the same amounts: 50,000 rubles and 120,000 rubles.

1 case.

The initial deposit is 50,000 rubles.

In the first year, you will be able to increase the deposit from 50,000 rubles to 294,000 rubles.

At the end of the second year, the deposit will increase to 940,000 rubles.

Case 2.

Initial contribution 120,000 rubles.

At the end of the first year, the deposit will increase from 120,000 rubles to 718,000 rubles.

After 2 years, the deposit will be 2,405,000 rubles.

Conclusion. Due to the fact that such tactics are not limited in time and the fact that the longer money is accumulated on a deposit, the more income you will receive in the future, there is a temptation to stick to this strategy longer and receive a huge income in a few years.

Conclusion.

I think the calculations given in this article showed you that in HYIPs you can get good income. You can choose from the 7 presented tactics the one that you consider suitable for you.