Card of sample signatures and seal of the organization. Card with sample signatures Bank card with sample signatures

Card with sample signatures and seal impressions- a document of the established form provided to the bank by a legal (or other) entity along with other documents necessary to open a bank account. This document contains: original handwritten signatures of managers with the right of first and second signature; sample seal of a legal entity.

Bank card with samples of signatures and seal imprint - this is one of the mandatory documents required when opening a bank account. Regulated by: Instruction of the Central Bank of September 14, 2006 No. 28-I “On opening and closing bank accounts, deposit accounts” (as amended on May 14, 2008, November 25, 2009); Directive of the Central Bank of the Russian Federation dated June 21, 2003 No. 1297-U “On the procedure for preparing a Card with specimen signatures and seal imprints” (as amended on March 25, 2004).

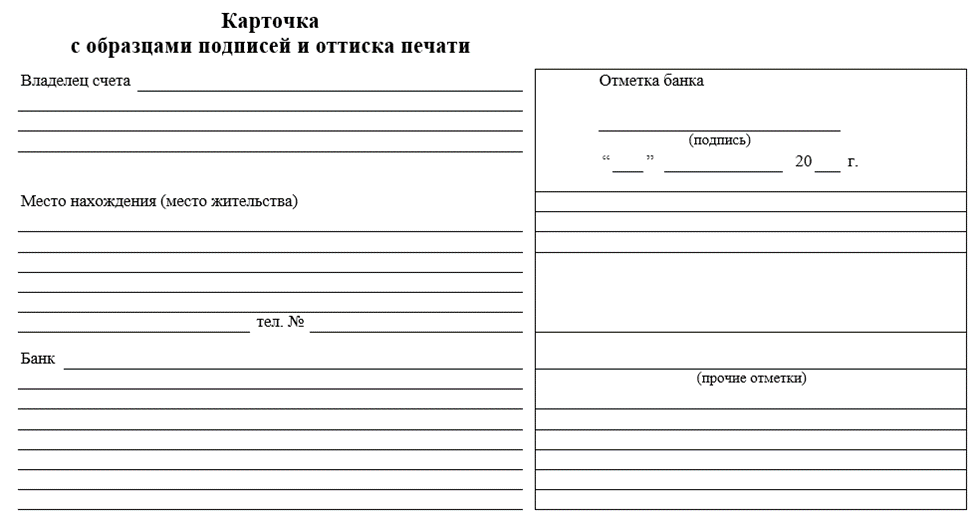

The bank card is issued using Form No. 0401026, established by Appendix 1 to the Instructions, and is presented by the client to the bank in cases provided for in the Instructions, along with other documents necessary for opening a bank account or deposit account.

The card is filled out using a writing or electronic computer in black font or with a pen with black, blue or purple paste (ink). The use of a facsimile signature to fill out the fields of the card is not allowed.

Sample signatures on the card must be made by the responsible persons themselves.

Card forms are produced by clients and the bank independently. The form of the bank card must strictly comply with the approved form. The bank will not accept a card with a different number or arrangement of fields. An arbitrary number of lines is allowed in the fields “Account owner”, “Cash checks issued”, “Other notes”, “Last name, first name, patronymic” and “Signature sample”, taking into account the number of persons vested with the rights of the first or second signature, as well as in the field “Bank account number” in the case provided for in clause 7.3 of the Instructions.

When making a card, it is allowed to indicate interlinearly the translation of the fields of the card in the languages of the peoples of the Russian Federation, as well as in foreign languages.

The “Sample of seal imprint” field must provide for the possibility of affixing a seal imprint with a diameter of at least 45 mm, without going beyond the boundaries of this field.

The number of cards submitted to the bank varies. Some banks ask for one copy of the card, and then make the required number of copies themselves. Others require the client to provide the required number of original cards

The right of first signature may belong to the head of the organization or another authorized person, in accordance with the administrative act (power of attorney) of the head.

The right of second signature may be vested in chief accountant or another (third) person authorized to conduct accounting in an organization, on the basis of an administrative act of the head of a legal entity. Situations are also possible when several employees of an organization can be granted the right of first and second signature at the same time. The head and chief accountant of the organization are not necessarily included in the list of these persons; for example, the founders of the organization may reserve this right for themselves.

Only persons who have the right of first signature can be indicated on the card (for example, if the head of the organization maintains accounting records himself). In this case, in the “Second signature” field, you must indicate that the right of the second signature does not belong to anyone.

Signatures are placed in the presence of a person who will certify their authenticity. This may be a notary (he will need to submit the same set of documents as to open a bank account) or an authorized person of the bank.

The bank employee certifying the client’s signatures fully indicates his position, surname and initials, surname and initials of the person (persons) whose signatures are made in his presence, indicates the date (in numbers) and affixes a handwritten signature with the seal (stamp) of the bank attached, specified for these purposes by an administrative act of the bank.

The card is valid until the bank account agreement is terminated, the deposit account is closed, or until it is replaced with a new card.

Submission of a new card to the bank must be accompanied by the simultaneous submission of documents confirming the authority of the persons indicated on the card to dispose in cash located in a bank account, as well as documents identifying the person (persons) vested with the right of first or second signature.

Sample card with sample signatures and seal imprint

The bank has no right to accept a new card without submitting the specified documents, except in cases where specified documents were submitted to the bank earlier and the bank already has them.

asset passive deposit card

If you are opening a current account for your individual entrepreneur or enterprise, then most likely a card with sample signatures and seals will become an integral attribute of this procedure. Organizations of any form of ownership and legal status. Let's look at what you need to know about this form and give a sample of filling out the card.

Why is a card needed?

The purpose of the card with sample signatures and seal imprint is quite simple and clear: it serves to ensure that employees of a banking institution clearly know what it should look like:

1. Original handwritten signature of the current account owner or his representative.

2. Company seal stamp.

After all, banks are special organizations that work with financial means their clients. It is extremely important for them to take all possible precautions when accepting, issuing and/or transferring them in order to prevent various abuses and fraudulent schemes.

In this regard, increased requirements are placed on signatures and seals: the main thing is that they must coincide exactly with those given on the bank card with samples of signatures and seal impressions, and be clear and legible. Otherwise, the transaction on the account will be refused.

The bank employee may ask the client to sign or re-stamp the form. And if the signature does not 100% match the one indicated on the signature card, the credit institution has the right to refuse to provide the requested banking service.

Mandatory stamp on the card

By the way, the form of the card with sample signatures does not necessarily contain a sample of the company seal. The fact is that from April 7, 2015, organizations can refuse to use round seals. They acquired this right after the Law of April 6, 2015 No. 82-FZ came into force. From this date, LLC and JSC (with some exceptions) have the right to independently decide whether to have a seal or not (prescribed in internal regulatory documents enterprises).

Previously, all domestic legal entities were required to have their own company seal (stamp). And businessmen, as now, can choose whether to conduct business with a seal or not.

One account – one card?

You can limit yourself to filling out one card with samples of signature and seal if the company opens more than one current account within one credit institution. A prerequisite in this case: access to the accounts is registered to the same persons.

And vice versa: you will need to issue several cards with signatures and a seal when the company opens current accounts in different banks. For example, due to more favorable tariffs(conditions) in another credit institution.

Who fills out the card

The document in question consists of 3 parts:

- the first is filled out by the general director of the enterprise or his representative, specifically authorized to do so by a power of attorney;

- the second (certifying signature certification) - a notary or bank employee;

- the third is a bank employee.

Card form

Let us say right away that there is no generally required sample signature card for a bank. At the same time, Instruction of the Central Bank of the Russian Federation dated May 30, 2014 No. 153-I “On opening and closing bank accounts, deposit accounts, deposit accounts” (hereinafter referred to as Central Bank Instruction No. 153-I) suggests using one of two options:

1. Form No. 0401026 according to OKUD (OK 011-93) from Appendix 1 to the specified Instructions:

2. Or a form for a card of sample signatures and a seal imprint according to the internal form of a bank or other organization (it necessarily includes all the details of form No. 0401026 according to OKUD (see above)).

As you can see, the card in form No. 0401026 includes only 2 signature samples and does not include such details as TIN, KPP, OKPO, OKVED codes, etc. That is, it contains a narrowly limited amount of information.

Filling out the card

For 2018, a sample of filling out a card with sample signatures looks something like this:

The rules for its design are as follows:

- can be filled out on a PC (if the bank is ready to issue it in electronic format) or with your own hand using a ballpoint pen in blue, purple or black ink (not a pencil!);

- facsimile signature is not acceptable;

- There should be no blots, inaccuracies, or corrections (the damaged form must be destroyed).

Each bank determines how many completed copies of the card are needed at its own discretion.

The most important thing: either a notary or a bank employee must be present when signing.

Temporary card

There is also a temporary signature sample card, which is attached to the permanent card. Externally, its only difference is that in the upper right corner on the front side there is a “Temporary” mark.

According to clause 7.13 of Central Bank Instruction No. 153-I, such a card is issued:

1. If the right to sign is temporarily transferred to persons not indicated on the original card.

2. In case of temporary use of an additional seal impression.

Then the card with samples of signatures and seal imprints is the main document that will have to be drawn up. What it serves for, what are the requirements for it - you will find out from the article.

What is the card for?

For the document there is standard form 0401026. It is approved by banking instruction No. 153-I. However, it is acceptable to use the form that you have set internal rules specific bank.

Why do you need a card with sample signatures and seal impressions? To obtain a current account:

- for current transactions for an individual;

- for the needs of individual entrepreneurs;

- for the needs of a legal entity;

- to open a deposit.

Courts, bailiff units, notaries, law enforcement agencies - all these organizations also need current accounts to operate. Therefore, you will need a card with sample signatures and seal impressions.

Forms produced by a printing house, as well as those printed independently on a printer, are acceptable for use. The card is issued to the client at the bank or can be obtained independently (for example, downloaded from the Internet from the website financial institution).

Special cases

A card with sample signatures and seal impressions is provided to the bank not only when opening a current account. There are a number of other cases:

- replacing one of the signatures;

- seal replacement;

- loss of seal;

- changes made to full name the person recorded on the card;

- changes in the name of the organization;

- changes in the organizational and legal form of the organization;

- suspension of powers of a management body;

- termination of powers of the management body.

A sample signature and seal on the card is necessary so that the bank employee has the opportunity to reconcile with the details specified in the payment document. If discrepancies are identified, the bank will not accept the document. Movements on the current account will not be possible.

Card with sample signatures and seal impressions: example of filling

Let's consider all the fields of the document sequentially. The “Account Owner” field must be filled in strictly in accordance with constituent documents companies. If an account is opened for a branch or separate division, then the name must be indicated separated by a comma after the main name.

If the client is an individual, then the full name is entered. and date of birth. If the client is an individual entrepreneur, then after indicating his full name. and the date of birth must be written: “ individual entrepreneur" If we're talking about about a person employed in private practice, then after full name. and date of birth, you must enter your occupation (for example, lawyer).

Field "Location". The organization enters its legal address here, individuals and individual entrepreneurs indicate the place of registration in accordance with the passport.

In the “Phone number” field, you can specify several numbers to contact representatives of the organization.

The "Bank" field must contain the full name financial organization in which the current account is opened.

The “Bank Mark” field is filled in by authorized employees of the credit institution; the client does not have to write anything down here.

Let's move on to designing the reverse side. Field "Abbreviated name". It is indicated only if it exists. Otherwise, the full name is repeated. Individuals here duplicate the information that was entered in the “Account Owner” field.

The line “Account number” is also filled in by a bank employee after the current account is opened.

In the “Name” field enter the persons who are authorized to sign documents. It could be one person, it could be more.

You must sign in the “Sample signature” field. Signatures on bank documents will be compared with this sample in the future, so it must be one that you can easily repeat in the future, otherwise difficulties will arise.

The “Term of office” field is not filled in in all cases; you must follow the instructions of the bank employee.

Item “Date of completion”. You need to enter the date when the card with sample signatures and seal impressions was issued.

Field “Client signature” - the document is certified by the personal signature of the account owner.

"Print sample". You need to put a stamp in this place. The print must be perfectly clear and neat.

To do this, the print must be well saturated with ink, but not leave blots. It is better to practice on a separate sheet of paper. After making sure that everything is fine, put a stamp in the field without violating its boundaries. If fragments of the stamp are poorly visible on the print, the card will have to be reissued.

It is better to have a ready-made card with samples of signatures and seal impressions in front of your eyes. An example will help you understand how to fill it out correctly and accurately.

Despite the fact that there is nothing complicated in filling out the document, it is better to do it at the bank under the guidance of a specialist, and not on your own. Banks are very attentive to every detail, even too strict. Filling out the card yourself may result in the need to redo the work several times.

What to do if an organization operates without a seal?

Individual entrepreneurs have the right to work without a seal, unlike legal entities. Individuals who open deposits and accounts for personal needs also do not have a seal. But the document is called “a card with samples of signatures and seal impressions.” What should I do?

It's simple. The instructions for filling out indicate that individual clients have the right not to fill out this field. If an individual entrepreneur has a seal, then its imprint must be affixed to the card.

How to confirm the authority of persons

The card with sample signatures and seal impressions (form 0401026) must be filled out by an authorized person.

What documents are required for confirmation?

Everyone is required to provide a passport. Individual entrepreneurs also provide registration certificates, legal entities - a set of statutory documents.

In some cases, notarization of the signature of the responsible person may be required.

If we are talking about a foreign organization, then a notarized translation of documents into Russian will be required.

Where is the card stored?

The document is filled out in one copy and stored in the bank. A card with sample signatures and seal imprints is a sample with which credit institution employees will check each payment document received for execution by the bank.

Card with sample signatures and seal impressions

A card with samples of signatures and seal impressions (abbreviated as COP) is of fundamental importance in modern banking for identifying a person, using a personal bank account. It is necessary to answer what this document is in 2017, determine the important requirements for its preparation, and at the end of the article the reader will be able to download a printable card form.

COP plays a major role in banking sector, it is necessary for individuals to work on bank accounts: opening, servicing, closing. The value of the card is so great that the Treasury and Central Bank Russia has approved the relevant Instructions and Orders (for example, Procedure 24n), which banks apply in their activities in 2017; these acts contain detailed information about the form of the COP, the rules for filling it out and other aspects of filling it out.

The form for this document can be downloaded at the end of the article or filled out directly at the bank. An employee of a financial institution can also enter the necessary information.

Attention! Only one thing is important - that the document complies with the form established by Russian legislation.

A correctly drawn up document is considered valid until the person closes his account or decides to change it. The latter is possible in the following cases:

- when changing the client’s statutory documents, for example, when changing the form of a legal entity or just the name;

- replacing the seal (for example, due to its loss);

- elimination or addition of one or more signatures, etc.

Detailed information about the rules for maintaining personal accounts, their types, etc. is specified in Procedure 24n.

Important points for correctly drawing up a card

Important! If the COP is drawn up in handwriting, then fill out the form fields using a pen with black or blue ink; purple ink is also allowed. If this is done on a computer, then you need to use a black font of the appropriate size.

The signature is affixed by the client himself; this is a mandatory condition. When servicing a personal account of a legal entity, there are several levels of signatures. For example, the manager and his official representative have the right of first signature, the accountant, by order of the manager, has the right of second signature. Options are also possible when the founders of a person (organization) have the right to sign, or when there is no right of a second signature at all (for example, if the client is an individual entrepreneur, and all work functions are concentrated on him).

According to the rules, the signature must be genuine, for this it is placed in the presence of a third party who will certify its validity. His role can be played by a notary or a person authorized by the bank: for example, one of the employees. In this case, he indicates his full name, position, date of compilation of the COP and puts his signature under the bank seal.

What is the procedure for filling out the card?

- The client fills in the line “Account owner” if he individual your full name, date of birth, type of activity, if legal entity- name of the organization in accordance with the constituent documents.

- In the line “Location (place of residence)” legal entity. the person indicates the address of the organization, physical. person - the address of his company or home address.

- Provide a contact phone number (possibly several).

- Next, in the “Bank” line, the name of the bank is written; “Bank Marks” and “Other Marks” are not filled in by the client.

- On the reverse side of the form, the name, client details, and bank account number (for the bank) are indicated.

- At the end, the client puts his signature, the date the card was filled out and a sample of the seal impression (if any).

You can download the COP form valid in 2017 below.

One of the main documents required by organizations to open and further maintain a bank account is a card with sample signatures and seal impressions. The form of the card was approved by Bank of Russia Instruction No. 28-I dated September 14, 2006 and was assigned OKUD code 0401026.

The card form can be produced (drawn up and printed) independently by both the bank and the client. But it must strictly comply with the approved form. It is only allowed to change the number of lines in the fields “Account owner”, “Last name, first name, patronymic” and “Signature sample” depending on the number of persons having the right of first and second signature.

There can also be any number of lines in the “Bank account number” field. But this is permitted if only one bank operational employee services several client accounts, and provided that the list of persons authorized to sign matches.

A bank card is filled out, usually using computer technology in black font, or by hand using a ballpoint pen with black, blue or purple ink.

Sample signatures on the card must be made by the responsible persons themselves. The use of a facsimile signature is not permitted.

The number of cards submitted to the bank varies. Some banks ask for one copy and then make the required number of copies themselves. Others require the client to provide the required number of original cards.

The right of first signature may belong to the head of the organization or another authorized person, in accordance with the administrative act (power of attorney) of the head.

The right of the second signature may be granted to the chief accountant or another (third) person authorized to maintain accounting records in the organization, on the basis of an administrative act of the head of the legal entity.

Situations are also possible when several employees of an organization can be granted the right of first and second signature at the same time. The head and chief accountant of the organization are not necessarily included in the list of these persons; for example, the founders of the organization may reserve this right for themselves.

Only persons who have the right of first signature can be indicated on the card (for example, if the head of the organization maintains accounting records himself). In this case, in the “Second signature” field, you must indicate that the right of the second signature does not belong to anyone.

Signatures are placed in the presence of a person who will certify their authenticity. This may be a notary (he will need to submit the same set of documents as for) or an authorized person of the bank. The bank employee certifying the client’s signatures fully indicates his position, surname and initials, surname and initials of the person (persons) whose signatures are made in his presence, indicates the date (in numbers) and affixes a handwritten signature with the seal (stamp) of the bank attached, specified for these purposes by an administrative act of the bank.